How the change in Plastic Packaging Tax affects your products on Erudus

We’re constantly updating and improving the way the Erudus platform and its solutions work - whether that’s because of feedback from our users or changes in the industry.

With that in mind we’re taking a closer look at the recently announced new plastic tax on product packaging, how it might affect Erudus users, and what we can do to help them adapt...

Why has there been a review on Plastic Packaging?

The production and breakdown of plastic packaging is creating an ongoing increase in greenhouse gas emissions.

Approximately 21–37% of total greenhouse gas emissions are caused by the food system. Due to population growth causing an increase in demand and dietary change^, this is estimated to increase by about 30–40% by 2050 If nothing is done to prevent it.

The government is now looking at what can be done to improve this situation.

What is the new Plastic Packaging Tax?

As a result of Part 2 of The Finance Bill 2021, a tax is being implemented early next year for plastic packaging containing less than 30% recycled material.

The tax will be set at £200 per tonne for packaging with less than 30% recycled plastic, and it is estimated that as a result of the tax, the use of recycled plastic in packaging could increase by around 40%.

The implementation of the tax will provide an economic incentive for businesses to increase the use of recycled plastic, therefore creating greater demand for recycled material, and fewer plastics being sent to landfill and incineration.

What packaging does this apply to?

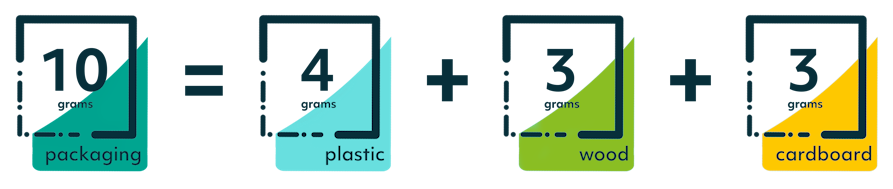

The new tax applies to "plastic packaging". This refers to all individual packaging components that contain more plastic by weight than any other packaging material - as in the below example. If the finished packaging is made up of more than one packaging component, you must account for Plastic Packaging Tax on each component (See more information here).

The Plastic Tax also applies to plastic packaging made or imported into the UK that does not contain at least 30% recycled plastic.

It does not apply to plastic packaging that contains at least 30% recycled plastic, or is not predominantly plastic by weight. It also doesn’t apply to Manufacturers or importers of <10 tonnes of plastic packaging per year.

Are there any exceptions to this Plastic Packaging Tax?

Exceptions to the Plastic Packaging Tax do exist, and they are as follows:

- Packaging where the function is secondary to the storage function, e.g. glasses case, CD case

- Packaging that has an integral part of the goods, e.g. ink cartridge, inhaler

- Packaging designed primarily for the presentation of goods and is reused, e.g. a display shelf/stand

There are also Exemptions to the Plastic Packaging Tax, as follows:

- Transport packaging used when importing goods into the UK, e.g. a plastic pallet/pallet wrap to protect the goods during transport

- Plastic packaging products used in aircraft, ship or railway stores for international journeys, e.g. goods sold on a plane

- Plastic packaging produced or imported for use in the immediate packaging of human medicine, e.g. a plastic pill bottle

- Components permanently designated or set aside for non-packaging use, e.g. film used on a plastic whiteboard

When is the new Plastic Packaging Tax coming into effect?

The tax will take effect from 1 April 2022.

This means that only packaging that is finished in the UK or imported into the UK and released onto the market after 1 April 2022 will be liable, and packaging finished or imported before the 1 April 2022 will not be liable.

Who is responsible for paying the new Plastic Packaging Tax on a product?

2 entities can be liable to pay the new Plastic Packaging Tax on a product. They are

Manufacturers of plastic packaging

The business responsible for finishing the component is responsible for paying the Plastic Packaging Tax if produced or modified in the UK.

OR

Importers of plastic packaging

If a component is imported and is already finished, the business that’s importing the packaging is responsible for paying the Plastic Packaging Tax.

What constitutes a finished product?

Packaging is considered “finished” when the last substantial modification is made before packing or filling. A “substantial modification” is a process that makes a significant change to the packaging component by changing the shape, structure, thickness, or weight. e.g:

- Extrusion (where the raw material is pressed through a die to form the required shape)

- Moulding (when plastic is moulded into a certain shape)

- Printing (where ink is applied to the plastic usually to give detail of the content)

(The above are all classed as substantial modification if they change the weight, shape, structure or thickness of the component)

There are 4 processes that change the weight, shape, structure or thickness that are not considered substantial modifications.

- Blowing (forming a packaging component from a preform. E.g. blowing bottle preforms into bottles)

- Cutting (e.g. cutting film to size, or cutting formed trays out of a larger sheet)

- Labelling (e.g. gluing a label to a tub or heating a shrink film label onto a bottle. However the label is likely to be classed as a packaging component in its own right for the purpose of Plastic Packaging Tax).

- Sealing (e.g. attaching a film lid onto a tub, or attaching 2 pieces of film together to close a bag)

What constitutes a substantial modification that would make a food Manufacturer liable to pay the Packaging Tax?

The business that undertakes the last substantial modification before the packing or filling process will be liable for the tax. So the final process could be carried out by the same business that finishes and fills the bottle, or by another business that supplies the preforms.

If you pack or fill the packaging, you will only be liable for the Plastic Packaging Tax if you also undertake a substantial modification before the packing or filling process. If a substantial modification takes place as part of the same process as the packaging being filled, it should be ignored for the purposes of determining when a component is chargeable for Plastic Packaging Tax.

If packaging you have made or modified is usable when you supply it to another business, and you do not have evidence that a further substantial modification will be made before the filling process, then you are likely to be liable to pay the tax.

You can find out more here.

Why should Manufacturers enter Packaging Recyclability as a product attribute on Erudus?

The Plastic Packaging Tax acts as an incentive for businesses to reduce their use of non-recyclable plastic, and whilst this will boost sustainability and green credentials and consequently make a product more attractive to many consumers, there are other direct benefits to inputting the plastic packaging content of a product into an Erudus specification.

For example, we already have several Wholesalers and private label owners who use Erudus requesting that packaging recyclability data be on specifications.

Their reasons for doing so are as follows:

- Private label owners have told us they will be directly affected by Plastic Packaging Tax as they import frozen food products from continental Europe and will therefore be liable for the Plastic Packaging Tax on those products.

- The Wholesalers want to be able to assess the impact Plastic Packaging Tax is going to have on their customers.

- One Wholesaler has already sent over a questionnaire to their suppliers asking them whether they will be affected by the tax and whether their products contain a minimum 30% recycled content.

- There is going to be a push from several Wholesalers to have the % of recycled content on all specs, and even more Wholesalers are likely to follow.

What are Erudus doing about the new Packaging Tax?

Erudus are currently reviewing our packaging fields, and considering adding a new attribute to product specifications that reflects the non-recyclable plastic packaging of a product. This might be:

- What % of the packaging is plastic? (e.g. weight of plastic / packaging x 100)

- What % of the plastic is recycled plastic? (e.g. <30% or >30% OR a free text field?)

We are looking for user feedback on the potential new field, so that it is best designed to help Manufacturers manage their products in accordance with the Plastic Packaging Tax.

According to HMRC it is important for Manufacturers to keep details of:

- The weight of each packaging component

- Evidence of recycled content

- Evidence of why the exemption applies (if applying for a tax return)

You may also be interested in…

You may also be interested in…